Smart Personal Financing and Budgeting Tips

Lets face it, budgeting your personal finances can be an overwhelming task that can easily become too much for a single individual to handle. When your income and spending habits remain steady, you may not have a problem doing so. However, once you begin to accrue other debt such as credit cards, personal loans, car notes, etc, your finances can easily spiral out of control.

Lets face it, budgeting your personal finances can be an overwhelming task that can easily become too much for a single individual to handle. When your income and spending habits remain steady, you may not have a problem doing so. However, once you begin to accrue other debt such as credit cards, personal loans, car notes, etc, your finances can easily spiral out of control.

One of the largest personal finance challenges individuals face is credit card debt. If you’ve ever owned a credit card, then you’re probably aware of just how easy it is for that balance to spiral out of control. As long as you’re making the minimum payments, most credit card companies will continue to increase your spending limit. As your maximum spending limit increases, so does the total amount you’re spending on interest and other fees.

The first step in eliminating your credit card debt is to identify which card is the biggest problem and focus on paying it off first. Common sense should tell you that the card with the highest interest rate is the one eating up most of your payments. Instead of your payments going towards the balance of your credit card debt, it’s simply being used to pay the interest rate. Go through the monthly statements of any and all of your credit cards to determine which one contains the highest interest rate and focus on paying it off first.

Paying off your credit cards isn’t something that’s going to happen overnight. After all, you didn’t accumulate all of that debt in just a day’s time, so you can’t expect it go away that quickly either. With that said, you’ll soon see substantial progress if you focus on paying off one card at a time. The balance will continue to go down until you’re at that happy zero mark. Just try not to get yourself into the same boat of credit card debt you were originally in once you’ve eliminated your balance on those deadly pieces of plastic.

In addition to keeping your spending down, you may also want to think about taking up a second job. As long as you have 10+ hours of free time a week, there’s no reason why you can’t use it to increase your revenue. I know this may be difficult for parents and individuals with other responsibilities, but most people shouldn’t have a problem picking up a second job. Perhaps you could cut out that those weeknight bar trips with your buddies. Not only will this free up some of your time, but it will directly save you money as well.

Contrary to what many people believe, the job market has actually picked up this year. With the recent growth of small businesses in our country, thousands of new jobs are created each year. You should take advantage of this growth by looking for a part-time job either online or in the newspaper. Think about what type of skills you can offer a company and find someone looking for your expertise. Everyone has something they’re good at and chances are there’s a company who needs those skills.

Amazon Unveils New Payment Model For Cloud Services

Amazon is arguably one of the largest and most popular providers of cloud-based services. Amazon Web Services delivers cloud-based computing power to thousands of businesses, big and small, from all parts of the world. While the e-retailing giant has long offered different payment methods, Amazon unveiled several new options this month. To learn more about the new payment options being added to Amazon Web Services, keep reading.

Amazon is arguably one of the largest and most popular providers of cloud-based services. Amazon Web Services delivers cloud-based computing power to thousands of businesses, big and small, from all parts of the world. While the e-retailing giant has long offered different payment methods, Amazon unveiled several new options this month. To learn more about the new payment options being added to Amazon Web Services, keep reading.

Like many cloud-based service providers, Amazon has long offered discounts to customers who pre-pay for their services. If a business owner is willing to pay ahead of time, he or she can expect to pay less for Amazon Web Services. Well, it appears that Amazon is now taking this payment platform one step further with the introduction of three additional Reserved Instance options.

The new payment options are broken down into three categories: all up front (pay for the entire term upfront), partial upfront (pay a portion of the term upfront, and no upfront (pay nothing upfront but commit to pay over the course of the term).

Amazon described the new Web Service payment options in a blog post, saying the following:

All Upfront – You pay for the entire Reserved Instance term (one or three years) with one upfront payment and get the best effective hourly price when compared to On-Demand.

Partial Upfront – You pay for a portion of the Reserved Instance upfront, and then pay for the remainder over the course of the one or three year term. This option balances the RI payments between upfront and hourly.

No Upfront – You pay nothing upfront but commit to pay for the Reserved Instance over the course of the Reserved Instance term, with discounts (typically about 30%) when compared to On-Demand. This option is offered with a one year term.

So, why is Amazon changing its payment options? Given the fact that Amazon is already an established leader in the cloud-based computing service business, some people are questioning the company’s recent payment change. Simply put, cloud services is a highly competitive business, with major tech companies like Microsoft, Apple, IBM and even Google trying to knock out Amazon. The e-retailer hopes these changes will encourage users to purchase its cloud services over its competitors.

What do you think of Amazon’s new payment model for cloud services? Let us know in the comments section below!

How To Set Up and Use an Owner’s Draw

An owner’s draw is a financial account in Quickbooks that’s used to track payments made to the business owner (hence the name). Every business owner must pay him or herself sooner or later. By recording these transactions in an owner’s draw, you’ll have an easier time keeping track of your business’s finances. If you’re interested in learning more about owner’s draw and how to set them within Quickbooks, keep reading.

An owner’s draw is a financial account in Quickbooks that’s used to track payments made to the business owner (hence the name). Every business owner must pay him or herself sooner or later. By recording these transactions in an owner’s draw, you’ll have an easier time keeping track of your business’s finances. If you’re interested in learning more about owner’s draw and how to set them within Quickbooks, keep reading.

Setting Up an Owner’s Draw Account

To create an owner’s draw, log into your Quickbooks account and access Lists > Chart of Accounts. At the bottom left-hand side of the screen, you’ll see a menu with “Accounts.” Click this link followed by “New.” Next, choose Equity > Continue.

You’ll be asked several questions regarding the new account, including what you’d like to name it (optional) and a description. Assuming you have just a single owner’s draw account, an easy name to remember is “Owner’s Draw.” If you have multiple owner’s draw accounts, however, you may want to include the name of the respective owner/payee in the name field for each account. When you are finished choosing a name and description, click Save & Close to complete the setup. Sorry if you were expecting more, but that’s all it takes to set up an owner’s draw account!

Writing Checks From an Owner’s Draw Account

Making payments from an owner’s draw account is a relatively simple and straightforward process. To write a check from the owner’s draw account, choose Banking > Write Checks, at which point a new window should appear asking you for more information. Under the “Pay to the order of” section, enter the business owner’s name to whom you wish to send the check, and the dollar amount of the payment. Last but not least, assign the amount of the check to the owner’s draw account. Click Save & Close to write the check and complete the process.

Remember, the owner’s draw account should only be used when making payments to the respective business owner. Using this account for your standard payroll isn’t recommended.

Were you able to set up an owner’s draw by following the steps outlined here? Let us know in the comments section below!

Fundamentals of Investment Accounting

Investment accounting is the process of analyzing and managing funds and accounts with the primary goal of earning interest or other non-monetary assets. It’s important to note that most medium-to-large sized businesses have some form of investment accounting taking place. Doing so is a simple and effective way to leverage some of their additional funds for higher profit margins. If you are interested in learning more, keep reading for the fundamentals of investment accounting.

Investment accounting is the process of analyzing and managing funds and accounts with the primary goal of earning interest or other non-monetary assets. It’s important to note that most medium-to-large sized businesses have some form of investment accounting taking place. Doing so is a simple and effective way to leverage some of their additional funds for higher profit margins. If you are interested in learning more, keep reading for the fundamentals of investment accounting.

The fact is that nearly every business can benefit from investment accounting. Instead of leaving the company’s money in a basic checking or savings account that receives little-to-no interest, that same money could be used as an investment; thus, generating even more funds for the company. Even in today’s tough economic times, there are still plenty of smart financial investments out there for business owners and entrepreneurs to invest in. It’s just a matter of choosing the right ones and carefully monitoring it for signs of changes.

Should I Hire an Accountant?

Nine out of ten times, hiring a professional accountant will almost certainly prove to be worth the cost. They’ll be able to closely monitor your financial accounts while analyzing them for any potential weaknesses. If something looks off, or if they believe your investments will take a nosedive in the near future, they will address these concerns to you. For the price, there’s no smarter way to manage your company’s investments.

Of course, the real benefit of hiring a professional accountant for your investments is the legal knowledge they bring to the table. Let’s face it, most of us are pretty clueless when it comes to the laws and regulations regarding financial investments. To make matters worse, these laws are constantly changing from year-to-year. So, how are you supposed to keep up with them? Unless you want to spend countless hours hitting the books and researching legal websites, it’s recommended that you follow the guidance of a professional accountant for your investments. They’ll recommend the best course of action regarding your financial investments that’s within the “legal” boundaries.

Investment and Accountant Software

Even if you make the decision to hire a professional accountant to monitor and analyze your investment portfolio, you can still benefit from the use of software. Quickbooks is hands down the most efficient type of accounting software on the market. It’s designed with a focus on simplicity, yet it’s capable of handling the accounting needs of any size business or company. You can have your accountant log directly in to your Quickbooks account to perform any necessary financial analysis.

When using Quickbooks, it’s important to choose the type that’s best suited for your investment needs. The most basic version, Quickbooks Online, is available for a per-month subscription basis, while some of the more advanced versions are self-hosted desktop suites that cost a flat fee. Take a few minutes to go through the features of each version to find the one that’s best fitted for your investment needs.

Intuit and Revel Partner To Support iPad Integration

Intuit and Revel recently partnered to launch a new iPad point-of-sale solution (PoS) that integrates directly with the current Quickbooks ecosystem.

Intuit and Revel recently partnered to launch a new iPad point-of-sale solution (PoS) that integrates directly with the current Quickbooks ecosystem.

According to a press release by the two companies, this new solution will leverage Intuit’s cloud-computing capabilities to automatically sync data without the need for additional steps on the user’s behalf. This includes the automatic synchronization of sales receipts, payments, inventory management, customer relations management (CRM), and payroll, all of which will be synched between the user’s iPad and his or her Quickbooks account.

Imagine being able to accept payments from customers using your iPad and then having this information automatically synched to your Quickbooks account. This isn’t the first system which allows business owners to accept payments using iPads or other mobile devices, but what makes Intuit’s point of sale system different is that it automatically syncs the user’s data with his or her Quickbooks. Rather than processing customer payments via the iPad and then manually updating your Quickbooks account to reflect this sale, the new PoS solution will combine these processes into one.

Eric Dunn, senior vice president for payments and commerce solutions, said this new feature is designed to give retailers a greater level of flexibility when accepting payments and managing their customer relationships. Dunn goes on to add that point of sale is powered by Revel Systems and Intuit — two of the industry’s leading cloud solutions.

“This is all about giving retailers maximum flexibility to accept payments and manage customer relationships anytime, anywhere, while staying grounded and confident because they can always access an up-to-date and accurate picture of their books,” said Eric Dunn, Intuit’s senior vice president for payments and commerce solutions. “QuickBooks Point of Sale powered by Revel Systems brings together the benefits of two leading cloud solutions to deliver an even more powerful result for food and retail businesses. ”

“We are thrilled to partner with Intuit and together both companies are creating a product, QuickBooks Point of Sale Powered by Revel Systems, that solves a huge need and a pain point for retailers today,” says Lisa Falzone, cofounder and CEO of Revel Systems.

Do you think Intuit’s new point of sale system will prove beneficial for business owners? Let us know in the comments section below!

Intuit Delivers New Features and Improvements To Quickbooks Online

Intuit unveiled dozens of new features, fixes and improvements to its Quickbooks Online products at the annual Quickbooks Connect Conference in San Francisco last month.

Intuit unveiled dozens of new features, fixes and improvements to its Quickbooks Online products at the annual Quickbooks Connect Conference in San Francisco last month.

Among the changes being made is a partnership between Intuit and the cloud-based storage service Box. The two companies plan to deliver a project collaboration center in Quickbooks Online Accountant. So, how will this new feature work? We still don’t know the details, but a spokesperson for Intuit said accounts and clients can share key information from within the Quickbooks online portal. So instead of emailing or faxing information to the accountant, clients can upload it directly to Quickbooks where the accountant is free to access it.

“Our partnership with Box is all about strengthening the relationship between small businesses and accounting professionals by making it easier than ever to share information,” said Wernikoff, the SVP of Intuit’s small business group. “The new document sharing center in QuickBooks Online Accountant is a way of leveraging the cloud to make the accountant-small business relationship even stronger,” he added.

Intuit also announced plans to launch a new payment API that will support third-party apps and programs. The goal is to streamline payments made to merchants who utilize Intuit’s merchant center. Delayed payments can spell disaster for small businesses, which is something that Intuit hopes to tackle with its new payment API. Third-party program and app developers can access this API to streamline payments made to merchants.

It appears that Intuit is finally putting its recent acquisition of itDuzzit to use. We broke the story of Intuit buying the cloud tech company itDuzzit for an undisclosed sum earlier this year. At the time, however, we didn’t know what Intuit had in store for the service. According to a spokesperson for Intuit, the company will use itDuzzit to create a new tool that bridges the gap between web apps and mobile apps. After a developer creates an app, he or she will be able to publish it within just two weeks at Intuit’s new Apps.com website.

Last but not least, Intuit has revamped its Quickbooks mobile app to include a wide range of new features like expense categorization, finger swipe functionality, and the ability to snap photos of bills and invoices to input them into your account.

4 Reasons Why You Should Use Cloud Computing

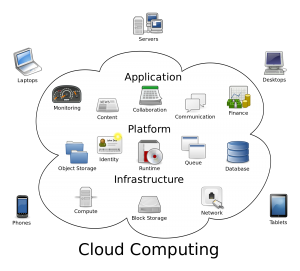

In the past few years, more and more services are using cloud technology. You can find everything from accounting software like Quickbooks Online to tax software and general word application programs available through cloud computing. Unfortunately, though, some people are still stuck in the mindset that it’s no better than using a traditional home computer. If you are on the fence about using cloud computing, keep reading to learn 4 essential reasons why you should make the switch.

In the past few years, more and more services are using cloud technology. You can find everything from accounting software like Quickbooks Online to tax software and general word application programs available through cloud computing. Unfortunately, though, some people are still stuck in the mindset that it’s no better than using a traditional home computer. If you are on the fence about using cloud computing, keep reading to learn 4 essential reasons why you should make the switch.

Reason #1 – Access Programs and Files Using Multiple Devices

Cloud computing refers to a technology where hardware and software is accessed from a remote location, typically using network or IP technology. This definition can undoubtedly be confusing to some, so let me try to explain it in more basic terms – think of a large cloud where all of your favorite programs and important data is stored. You can access this cloud using multiple devices from anywhere in the world. Depending on the particular service or program, it will usually allow you to use everything from your computer to tablet PC and smartphone.

Reason #2 – Protects Your Files

I think we’ve all been the victim of a system crash or hardware failure that resulted in a loss of data. The good news is that cloud computing saves all of your data at a remote location where it’s protected against such disasters. If your home computer were to crash or even get stolen, all of your important data would still be saved on the cloud. You simply log back into the cloud, download the files on your computer or device, and it’s like nothing ever happened. This alone should be reason enough for you to make the switch to cloud computing.

Reason #3 – Works With Multiple Users

Ever find yourself working on a project with other people? Trying to pass a USB drive back and forth probably isn’t the best way to share information. You might as well be sending smoke signals if you are still using USB flash drives. Instead, you should consider working on the project through a cloud-based medium. Doing so will allow everyone to work on the project at the same time without any discrepancies.

Reason #4 – Faster and More Efficient

A forth benefit of cloud technology is the fact that it uses hardware at a remote location. When you are crunchy heavy numbers and date, you’ll need a processor that’s capable of performing these intense operations. Traditional home computers might not offer enough power for this type of computing; however, high-end servers stored on the cloud are designed for extreme workloads, making them a better choice.

Hopefully, this will give you some insight on cloud computing and the reasons why so many people are using it. Cloud computing is a simple concept with some enormous benefits that shouldn’t be ignored. While we’ve listed 4 of the top benefits here, there are many other reasons why people use it.

3 Reasons To Choose Quickbooks For Your Accounting Needs

Every business, no matter how big or small, will require accounting work to keep a balanced budget. Creating and sending out payroll, dealing with incoming checks, transactions and company expenses are all integral parts of business accounting. While you can do most of these functions using a pen, legal pad and calculator, you’ll likely find the use of Intuit Quickbooks to be a valuable time saver that makes accounting easier and less stressful. Here we’ll take a closer look at some of the reasons why you should use Quickbooks for your accounting needs.

Every business, no matter how big or small, will require accounting work to keep a balanced budget. Creating and sending out payroll, dealing with incoming checks, transactions and company expenses are all integral parts of business accounting. While you can do most of these functions using a pen, legal pad and calculator, you’ll likely find the use of Intuit Quickbooks to be a valuable time saver that makes accounting easier and less stressful. Here we’ll take a closer look at some of the reasons why you should use Quickbooks for your accounting needs.

Quickbooks is the world’s most popular type of accounting software with thousands of individuals and companies using it worldwide. The company responsible for producing Quickbooks, Intuit, was originally formed back in 1983. Founders Scott Cook and Tom Proulx saw the need for a small business accounting solution; and this is what drive the duo to create Quickbooks.

Reason #1 – Organization

When you are dealing with hundreds of even thousands of financial transactions, it can become quite a headache trying to organize them by hand. The old manilla file folder system just doesn’t work in today’s day and age. If you are ever forced to try and locate a transaction, you’ll have to dig through mounds of paperwork in hopes of coming across it. Thankfully, Quickbooks makes organizing all of your financial accounts and transactions a breeze. It uses a clean and simple interface for users to manage all of their financial information. Whether you are experienced with Quickbooks or not, chances are you’ll have no problem keeping your accounting information organized.

Reason #2 – Payroll

Do you find yourself spending countless hours staring at the computer trying to get employee payroll out in time? Instead of tallying up all of the numbers by hand, you can setup your Quickbooks account to handle the job for you. As long as you’ve entered in the correct information regarding employee hours and accounts, it will send out payroll automatically. This alone is reason enough to make the switch over to Quickbooks for your business accounting needs.

In addition to payroll, Quickbooks will also send out payments to clients you pay on a regular basis. If your business relies on services or products from another company, just set this up in the same area of your Quickbooks account. There’s no easier way to have payments automatically sent out than by using Quickbooks.

Reason #3 – Automatic Check Deposit

A third reason why you should use Quickbooks is the automatic check deposit feature it offers. Instead of going to the bank every time you receive a check, you can scan it, upload it to your Quickbooks account, and then have it directly deposited into your bank account. No longer are you forced to make several trips back and forth to the bank throughout the week. Just scan any checks your business receives and deposit them from the comfort of your home or office.

Quickbooks Tips and Tricks

Quickbooks is designed so that practically anyone can perform their own business accounting. It features a clean, easy-to-navigate interface that walks you through the process. Regardless of your previous accounting experience, you should have no problem finding your way through Quickbooks. However, there are certain tips and tricks that may speed up your accounting. If you are looking to spend less time on accounting and more time running your business, you should check out some of the following tips.

Quickbooks is designed so that practically anyone can perform their own business accounting. It features a clean, easy-to-navigate interface that walks you through the process. Regardless of your previous accounting experience, you should have no problem finding your way through Quickbooks. However, there are certain tips and tricks that may speed up your accounting. If you are looking to spend less time on accounting and more time running your business, you should check out some of the following tips.

Use Shortcut Keys

If you aren’t using shortcut keys during your Quickbooks accounting, you are typing more than what’s necessary. Quickbooks is designed with dozens of shortcut keys, allowing you to quickly access certain areas of your account. For instance, Ctrl + N opens up a new transaction window. Instead of manually clicking through the dropdown box at the top of the page to find the new transaction window, you can simply click Ctrl + N. Of course, this is just one of the many shortcut keys implemented in Quickbooks. Here are a few others…

Ctrl + R – Access transaction registrar.

Ctrl + Y – Display journal.

Ctrl + H – Display transaction history.

Ctrl + Z – Undo.

Ctrl + D – Delete transaction.

Ctrl + F – Find.

Ctrl + D – Edit.

Ctrl + I – Create Invoice.

Ctrl + P – Print.

Right Click

Another neat little tool Quickbooks features is the use of right-click menus. As the name suggests, this feature allows you to pull up menus simply by right clicking. Although it’s not available in every area, Quickbooks does allow for right-click menus in a number of different sections. Before you go clicking on the dropdown menu at the top of the page, first check to see if right-click menus are enabled. You can do this simply by right clicking on the appropriate field of text. If the feature is enabled, you’ll see a new menu appear of the text, at which point you can select the desired action.

Reconciliation

Reconciliations are done to check for potential errors or typos in a Quickbooks account. Let’s face it, no matter how hard you try to prevent it, typos are bound to happen. When you are punching numbers away into your Quickbooks account for hours on end, you may accidentally leave a digit out of a certain transaction. As you may already know, just one wrong number can throw your entire account out of whack. The good news is that Quickbooks has a reconciliation feature that allows users to go back and look for errors such as this.

Above all else, carefully read and familiarize yourself with the Quickbooks user manual. Since there are over half a dozen different types of Quickbooks software, some of them unique features. Going through the user’s manual will identify these features, revealing how to effectively use them in your accounting projects.

How To Set Up Payroll In Quickbooks

Quickbooks offers a number of helpful features to make business accounting quick and easy. One of the most commonly used features on Quickbooks is payroll setup. If your business operates with multiple employees, you’ll want to take advantage of this highly beneficial feature. Instead of manually writing out each and every paycheck to your employees, you can setup your Quickbooks account to perform this task for you. To learn more about setting up payroll in Quickbooks, keep reading.

Quickbooks offers a number of helpful features to make business accounting quick and easy. One of the most commonly used features on Quickbooks is payroll setup. If your business operates with multiple employees, you’ll want to take advantage of this highly beneficial feature. Instead of manually writing out each and every paycheck to your employees, you can setup your Quickbooks account to perform this task for you. To learn more about setting up payroll in Quickbooks, keep reading.

There are several different “types” of Quickbooks software, including Quickbooks Online, Pro, Premier and Enterprise. Each of these types comes with their own unique features, so it’s important to choose the right one based on your accounting needs. Thankfully, all of them offer the payroll setup feature at no additional cost. Whether you choose the $39.95/month Quickbooks Online or Quickbooks Enterprise at $999.95, you’ll still be able to use the payroll feature.

Getting Started

The first step in setting up payroll is to launch your Quickbooks account and click on the “Employees” tab at the top of the screen. This should open up a drop-down box with several new items. Scroll through the items in the drop-down list and choose “Payroll Setup.” This should now direct you towards the built-in Wizard for Quickbooks payroll solutions.

The Wizard makes setting up payroll is a simple and straightforward task. You’ll be asked to enter and verify different information regarding your business and payroll, some of which includes Employer Identification Number (EIN), employees and their social security numbers, year-to-date payrolls, dates, etc. Double check all of this information before submitting to ensure it’s accurate. While payroll mistakes can be fixed, it’s better to get things right the first time around.

Adding New Payroll Items

After setting up your payroll account through Quickbook’s built-in Wizard, you can then add new items in just a few easy steps. Start by selecting “Lists” followed by “Payroll Lists.” This will allow you to view your current payroll items and add new ones. You should see a button titles “Custom Setup” while viewing your payroll lists. Click on this button to add a new payroll item to your account.

You will need to enter the cemployee’s name, tax information and date before the process is complete. Once this is done, you can name the payroll item to make so it’s easier to find in the future. Depending on the size and structure of your business, you might want to simply name it after the respective employee. Doing this will allow you to find a worker’s payroll item by searching for their name in your Quickbooks account.

Setting up payroll for a business has never been easier than to Quickbooks. Whether you have the Online or Desktop version, you can set up payroll in minutes. Refer back to this guide for guidance on setting up payroll in Quickbooks. If for whatever reason you are stumped, give their customer support number a call. Quickbooks is know their exceptional level of customer support, helping customers tackle any hurdles or problems that may arise.