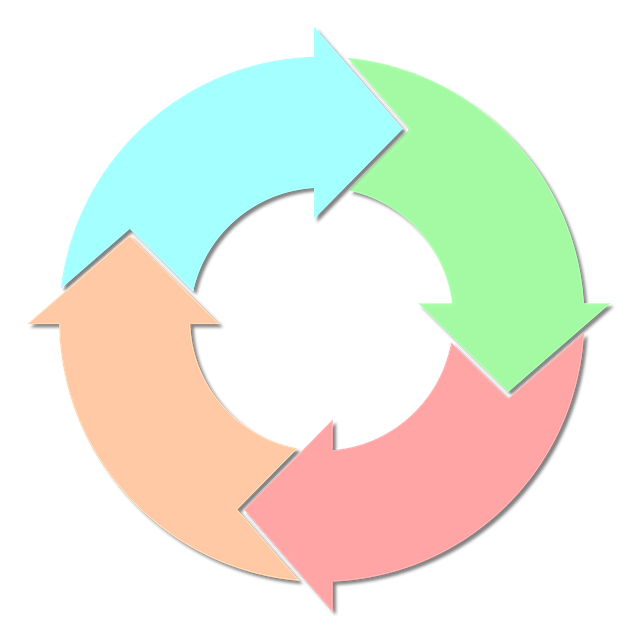

The 4 Steps of the Accounting Cycle

Accounting is essential to running a successful business. If you don’t know how much money your business spends, as well as how much money it generates in sales revenue, you’ll struggle to create a profitable business. While there are different ways to approach accounting, one of the popular methods involves the four-step accounting cycle. In just four simple steps, you can keep track of your business’s financial information.

Accounting is essential to running a successful business. If you don’t know how much money your business spends, as well as how much money it generates in sales revenue, you’ll struggle to create a profitable business. While there are different ways to approach accounting, one of the popular methods involves the four-step accounting cycle. In just four simple steps, you can keep track of your business’s financial information.

#1) Analyze Transactions

The first step of the accounting cycle is to analyze transactions. Transactions may consist of receipts and invoices. Receipts, of course, denote an expense, whereas invoices denote revenue generated. To begin with the accounting cycle, you must identify all of your business’s transactions for the given financial period.

#2) Record Transactions

After analyzing your business’s transactions, you’ll need to record them in the form of journal entries. Journal entries are a form of structured data about transactions. They typically include the date of a transaction, the dollar amount of a transaction, the account number associated with the transaction and a brief description. If you use Quickbooks, you can create journal entries for your business’s transactions using the accounting software.

#3) Add Journal Entries to General Ledger

The third step of the accounting cycle is to add the newly created journal entries to your business’s general ledger. The general ledger is a document that contains journal entries for transactions. Also known as the nominal ledger, it serves as the central hub for accounting processes. You can review your business’s general ledger to gain a better understanding of its financial health. Once you’ve identified your business’s transactions and recorded them in the form of journal entries, you should add those journal entries to your business’s general ledger.

#4) Run an Unadjusted Trial Balance Report

The fourth and final step of the accounting cycle is to run an unadjusted trial balance report. What is an unadjusted trial balance report exactly? It’s a summary of all the balances in your business’s general ledger. With an unadjusted trial balance report, you’ll see an overview of your business’s transactions displayed neatly in a single report.

The accounting cycle may seem confusing, but it’s actually rather simple. It consists of four basic steps: analyze transactions, record transactions, add journal entries to the general ledger and run an unadjusted trial balance report.

Have anything else that you’d like to add? Let us know in the comments section below!